As financial Advisor with over four years of experience, I helped various clients to grow their wealth. A lot of investors struggle with this one question. Mutual funds and index funds are both excellent investment options. In 2026, Choosing the correct one is more important than ever.

Various Individuals have benefited from my advice in both bull and bear markets. One thing stays clear: Most investors achieve superior returns from inexpensive and simple investment options. Now, let’s differentiate between index funds vs. mutual funds so you can choose where to allocate your capital this year.

What Are Index Funds?

Index funds are passive investments. They track a market index, like the S&P 500 or Nasdaq. The goal is simple: match the market’s performance, not beat it.

Managers don’t pick stocks. The fund just buys what’s in the index. This keeps things hands-off.

In 2026, index funds remain popular. More money flows into passive strategies every year. Low costs and steady returns drive this trend.

What Are Mutual Funds?

Mutual funds pool money from many investors. A professional manager actively picks stocks or bonds. The aim: outperform the market.

Many mutual funds are active. Managers research and trade to find winners. Some focus on growth, value, or sectors.

Active mutual funds can shine in volatile markets. But they come with higher fees.

Key Differences: Index Funds vs Mutual Funds

Here are the main differences.

Management Style

- Index Funds: Passive. They follow the index automatically.

- Mutual Funds: Active. Managers make decisions.

Fees

- Index Funds: Very low expense ratios, often 0.03% to 0.20%.

- Mutual Funds: Higher, usually 0.5% to 1.5% or more.

Performance

- Index Funds: Mirror the market. Consistent over time.

- Mutual Funds: Aim to beat the market. Results vary by manager.

Risk

Both diversify. But active funds can take bigger bets.

Pros and Cons of Index Funds

Pros

- Low costs eat less of your returns.

- Easy and predictable.

- Historically strong long-term performance.

- Less manager risk.

Cons

- No chance to beat the market.

- Full exposure to downturns.

In my experience, index funds suit most people. They deliver market returns without the guesswork.

Pros and Cons of Mutual Funds

Pros

- Potential to outperform in certain markets.

- Expert management.

- Some specialize in niches.

Cons

- Higher fees reduce net returns.

- Many underperform their benchmarks.

- Manager risk if they leave.

Performance Trends in 2026: What the Data Shows

Data tells the story. Reports like SPIVA show most active mutual funds lag behind indexes over time.

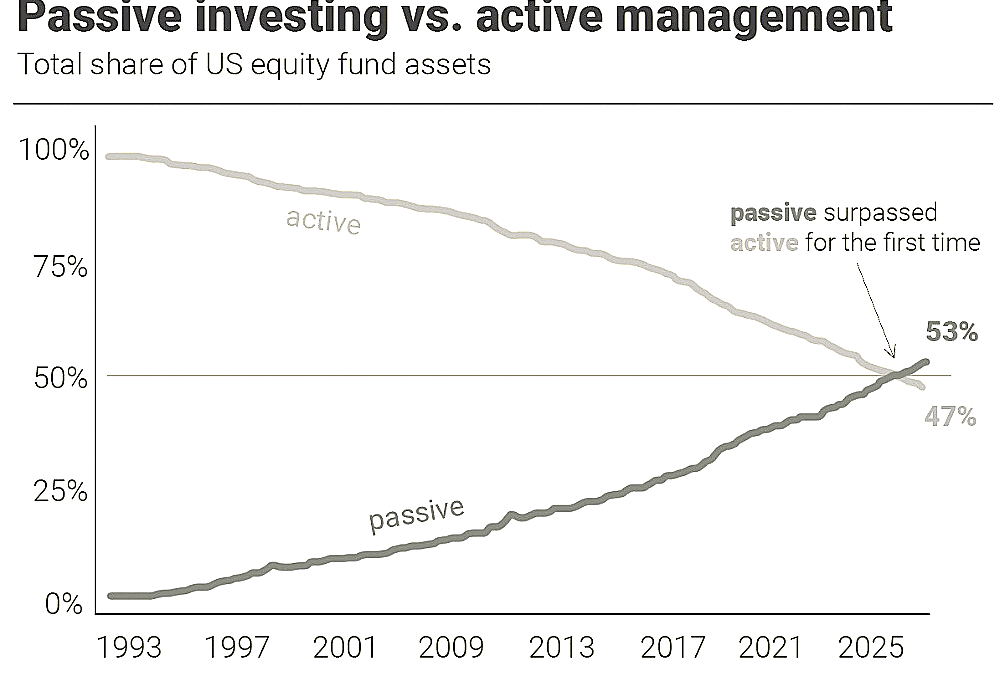

More than 60–80% of active funds have performed poorly across multiple categories in recent years. This pattern persists until 2026. In many regions, passive investing now has more assets than active investing.

Why? Fees compound. Even a 1% difference adds up over decades.

In 2025, passive funds grew faster. Low-cost leaders like Vanguard cut fees again. This makes index funds even better.

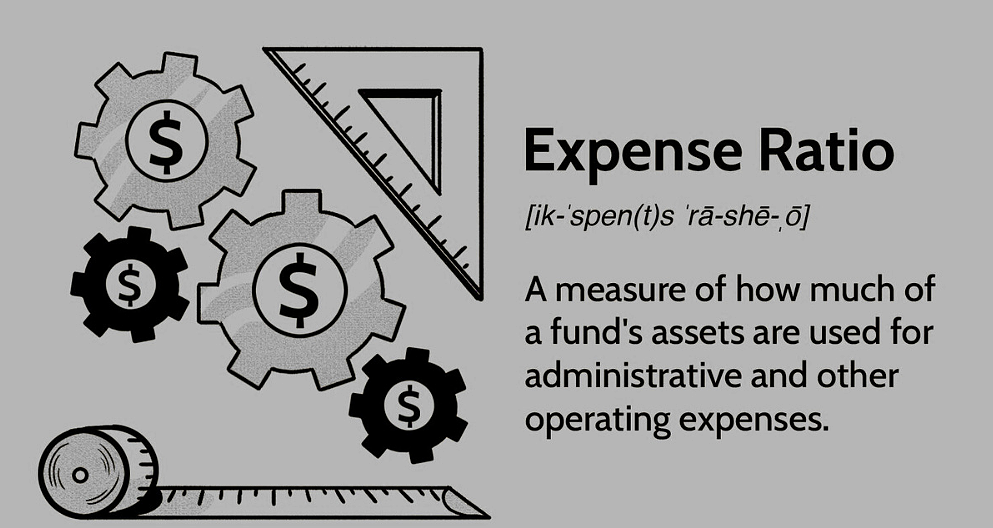

Costs Matter More Than Ever

Expense ratios are key. In 2026, top index funds charge under 0.10%. Active mutual funds often charge 10 times that.

Over 30 years, low fees can add tens of thousands to your nest egg. I’ve run these numbers for clients many times.

Look for funds with rock-bottom costs. Every basis point counts.

Where Should You Invest in 2026?

It depends on you. But for most investors, index funds win.

If you’re building long-term wealth, like for retirement, go passive. A simple S&P 500 index fund has beaten most active options over time.

Want some active exposure? Allocate 10-20% to proven mutual funds. But keep the core in index funds.

In 2026, markets look strong but volatile. AI, energy, and global shifts create opportunities. Index funds give broad exposure without picking winners.

Factors to Consider

- Your time horizon: Longer favors index funds.

- Risk tolerance: Active can add volatility.

- Goals: Diversification matters.

- Taxes: Index funds often more efficient.

Always diversify. Mix stock and bond funds.

Final Thoughts

After years advising clients, I recommend index funds for most in 2026. They offer low costs, solid returns, and peace of mind.

Mutual funds have a place for those seeking outperformance. But data shows it’s hard to find consistently.

Start simple. Invest regularly. Let time do the work.

Your future self will thank you. If you have questions, consult a advisor for your situation.